Posted on November 21st, 2018 by SuperGuardian

Whilst the TSB will impact numerous elements of fund administration, it’s greatest impact will be felt on the contribution rules.

This bulletin will revisit the rules around accepting contributions and then consider the impact the TSB will have on contributions.

The Superannuation Industry (Supervision) Regulations outline the rules for a Fund Trustee to consider when accepting non-mandated contributions, such as personal contributions. An SMSF Trustee can accept a contribution for members aged under 65 without the member needing to satisfy a work test.

A member aged 65-74 must satisfy a work test to be eligible to contribute to their SMSF, unless the contribution is a downsizer contribution which does not require the work test to be satisfied. The work test is 40 hours of gainful employment within a period of 30 consecutive days. To be considered gainful employment the person must provide a service and be remunerated for doing so. Voluntary work does not count. Trustees that undertake activities such as managing their own investment portfolio would also not satisfy the definition of gainful employment.

Draft legislation has recently been introduced to allow members to make contributions post age 65 without meeting the work test, the proposal will allow a member to contribute in the year following their retirement, however, like many other contribution rules this will be linked to the member’s TSB.

If a member makes a contribution on the assumption that they will satisfy the work test during a particular financial year, post age 65, failure to meet the test would result in the trustees not being able to accept the contribution and the contribution must be returned.

Previously, a Fund trustee was unable to accept a contribution that exceeded the member’s non-concessional contribution cap. This “fund-capped contribution” rule only applied to each individual contribution and resulted in the excess contribution being subject to the above refund provisions.

From 1 July 2017 this rule no longer exists and the member’s capacity to make non-concessional contributions or be subjected to the excess non-concessional contribution rules is now subject to the TSB, more on this later.

A Contribution is defined by the ATO as an amount that increases the capital or property of a fund.

Exclusions to this definition are amounts that are received by the fund that are income, profit or gain from investments of the existing capital or realisation of an investment of the existing capital.

A contribution can be made by any of the following means:

• Money or money equivalent

• Transferring an asset

• Other forms (money’s worth)

A money or money equivalent contribution includes:

• Cash (Australian, foreign)

• Money Order

• Electronic Transfer

• Bank or personal cheque

• Similar Negotiable Instrument (Promissory Notes)

Transferring Assets is another means by which contributions can be made to a Fund:

• Satisfying a liability of the fund on behalf of the trustees

• Forgiveness of debt by a lender

• Guarantor satisfies a loan obligation of the trustee (S67A)

• Increasing the value of an asset already owned by the Fund

A Roll-over superannuation benefit is a contribution for taxation purposes but not for the purposes of the contribution caps or contribution acceptance rules.

Transfers from foreign superannuation funds are also considered contributions.

Money or money equivalent contributions are made when the money is received by the Fund. This is usually the date as indicated on the bank statement. Contributions via cheques and promissory notes are made when the cheque (or note) is received by the trustee of the Fund. Cheques and promissory notes that are subsequently dishonoured are not considered contributions. Contributions via post-dated cheques or promissory notes are made at that latter of the date on the cheque (or note) or date received by the trustees.

Property (assets other than money or money equivalent) is received when either the legal or beneficial ownership passes from the contributor to the trustees. If there is no formal registration process to evidence ownership, the ownership passes to the trustee when they physically take possession of the asset.

Where there is a formal registration process the ATO’s view is that ownership and therefore the contribution is made when the Fund trustees are registered as the owner of the property. Legal ownership can often occur sometime after beneficial ownership of property passes. The ATO accept that the contribution is made when beneficial ownership is obtained.

For real property beneficial ownership is obtained when the trustees are in receipt of the requisite transfer forms and there is no legal impediment stopping the fund from effecting the transfer (in-specie contribution of real property). When there is a formal sale and acquisition of real property beneficial ownership will pass when the purchase is settled.

If listed securities are contributed to a fund the ATO provides slightly different interpretations based on how the shares are transferred. The Trustee must hold proper legal title to the shares to be considered the owner.

An in-specie contribution of listed securities is made when the trustee of a fund obtains a properly completed off-market share transfer form, the amount of the contribution will be the MARKET VALUE at the time the contribution is made.

In addition to understanding when a contribution is made and how it can be made, it is also necessary to understand what, if any, restrictions apply to the types of contributions you want to make.

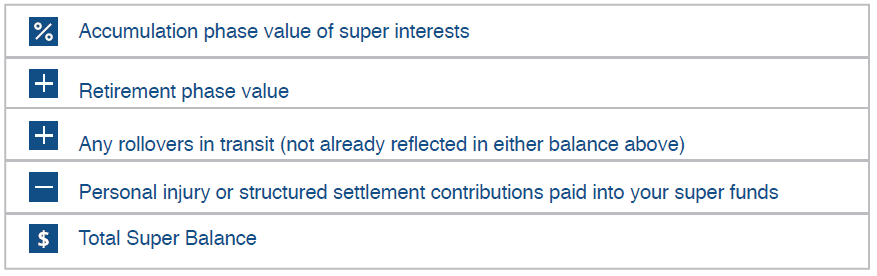

Your TSB is a way to value your total super interest at a particular date, 30 June each year, and is now used to work out your eligibility for the following contribution linked measures:

• Making non-concessional contributions (and the availability of the two or three year bring forward period)

• Catch Up Concessional contributions where the unused cap can be carried forward

• Government co-contribution

• Tax offset for spouse contributions

• Post age 65 work test exemption contributions (from 1 July 2019 subject to passage of legislation)

The TSB will also affect the event based reporting frequency of a fund for transfer balance cap purposes and eligibility to claim exempt current pension income (ECPI) under the segregated assets method. Asset segregation and ECPI will be the subject of a future bulletin.

Your TSB is not just based on what is in your SMSF administered by SuperGuardian, so it’s important that the balances of any other external super accounts are made available to ensure we can work out your eligibility for the above, where relevant.

It should also be noted that there can be some confusion between the new total super- annuation balance and the transfer balance cap. The total superannuation balance is effectively the total amount an individual has in superannuation whereas the transfer balance cap is a cap on the amount an individual can use to commence a retirement phase pension.

This is generally the withdrawal value of an accumulation balance. It can also include transition to retirement pensions (not in retirement phase) and super income streams that do not comply with the pension standards or a commutation authority.

How much someone has is actually a reflection of how much they would be entitled to receive should they take their benefit out. Therefore, the accumulation phase value, particularly when referencing SMSF members, should contemplate such things as deferred tax liabilities. This is something that not all SMSFs account for. It is also worth pointing out that SMSFs reflect the market value of assets held at 30 June each year, this market value does not incorporate the cost of selling the assets.

The TSB is reported as part of the SMSF annual return and the default calculation will reflect the member balances as attributable in the return. The capacity exists to modify these amounts, within the return, to accommodate net market value and potentially deferred tax liabilities.

If you only have account based pensions, the retirement phase value is generally the current value of the pension accounts.

However, rather than identify the total superannuation balance as the value of any account-based income stream, in actual fact the amount is calculated as an individual’s transfer balance, modified if the individual is in receipt of a ‘prescribed’ account-based pension. Prescribed account-based pensions incorporate every type of retirement phase account-based pension an SMSF is likely to pay, so in every set of circumstances where an SMSF pays an account-based pension the transfer balance account needs to be modified.

If we assume a normal scenario i.e. an SMSF without any structured settlement contributions, bankruptcy or relationship breakdown payment splits, then the modification requires you to disregard any credits associated with commencing an income stream and disregard any debits linked to commutations and failures to comply with commutation and pension standards.

You are then required to increase the transfer balance account by the value of the retirement phase income stream if the amount was withdrawn in full. Therefore, with the exception of structured settlement payments, the only information from the transfer balance account that is considered in the total superannuation balance is any excess transfer balance earnings.

For capped defined benefit income streams the total superannuation balance is the transfer balance account value. Importantly market linked pensions, regardless of when they are commenced, are account-based pensions for total superannuation balance purposes, even if they are capped defined benefit income streams for transfer balance cap purposes. Therefore, for any market linked pension, regardless of whether or not the pension was commenced pre or post 1 July 2017, the modified transfer balance calculation needs to be performed and the special value for transfer balance purposes is ignored.

1. Making non-concessional contributions (and the availability of the two or three year bring forward period)

If the TSB of a member exceeds $1.6m at 30 June then they cannot make non-concessional contributions, or if they do they will be subject to the excess non-concessional contribution rules which do not allow for the excess to be refunding directly but rather via the ATO.

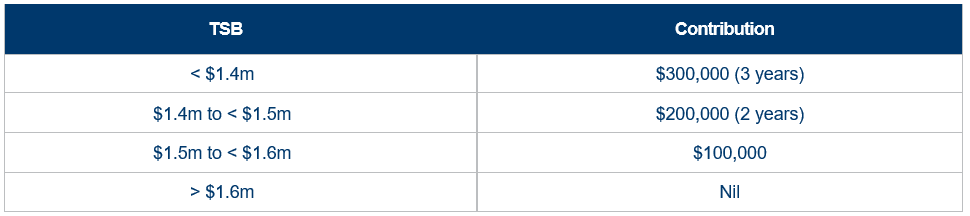

The following table shows how the value of the TSB affects the non-concessional contributions cap and also whether the two or three year bring forward period can apply for members under the age of 65 on 1 July:

As can be seen by these numbers, any capacity to legitimately reduce the TSB will provide a lasting benefit to the member.

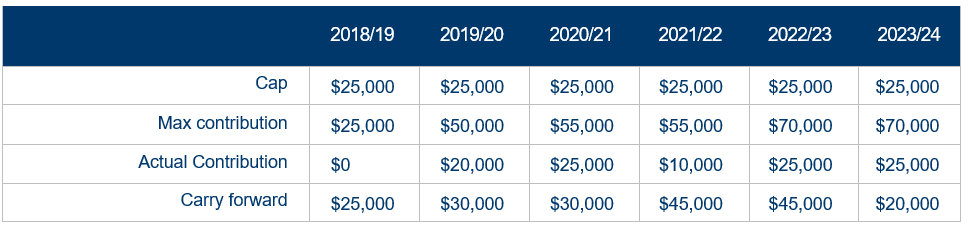

2. Concessional contributions cap where the unused cap can be carried forward

When we get to a position of determining an individual’s TSB at 30 June 2019, members with a TSB of less than $500,000 have the ability to access an increased concessional contribution cap the following year where they haven’t fully utilised the concessional cap in the previous year. Further, as time progresses, this measure will allow for any unused cap to be carried forward for up to five years and then anything not used after 5 years will expire. This measure only applies to unused amounts accrued from 1 July 2018.

The following table demonstrates an example of how the carried forward rules apply (the example assumes no move- ment in the concessional contribution cap):

3. Government co-contribution

You will not be eligible for the government co-contribution if your TSB at the start of the financial year is equal to or greater than the general transfer balance cap of $1.6m or you have exceeded your non-concessional contributions cap in that financial year.

4. Tax offset for spouse contributions

You will not be eligible for the tax offset for spouse contributions if your spouse’s TSB at the start of the financial year is equal to or greater than the general transfer balance cap of $1.6m or your spouse has exceeded their non-concessional contributions cap in that financial year.

5. Post age 65 work test exemption (draft legislation)

Whilst this proposal is still in draft format, if it passes in to law then the ability for an individual to access the measure and make contributions in the year after they turn 65 or cease working, whichever is the latter, will be reliant on the member having a TSB of less than $300,000.

On the face of it, this is a simple new concept, however as you can see there are many complexities to consider and it affects a range of concessions so it’s important to get it right. Fund members will need to know their TSB to be able to confidently make decisions about contributions and in many cases it’s not just a matter of adding up the member’s benefits.

Further, as the ability to make certain contributions will be subject to the member’s TSB, the need to know the TSB as early as possible means utilising a suitable administration process will be a necessity for many.