Technical Bulletin:

Rent and loan relief

guidelines for commercial properties

SuperGuardian have been monitoring the rent relief situation closely, reviewing commentary from the Government, the ATO and importantly the audit firms we work with. Whilst there is no clear national response relating to residential property, other than an expectation that there be no evictions for six (6) months for anyone impacted by COVID-19, commercial tenancy has been addressed with far more clarity.

This is an important issue for SMSFs because a significant portion of commercial property held by SMSFs is leased to related parties of the trustees of the fund. From a superannuation compliance perspective providing rent relief to related parties, and by extension providing repayment relief to related party borrowings, could trigger contraventions of the following key investment restrictions:

• Sole Purpose Test

• Provision of financial assistance to members or relatives of members

• In-house asset rules

Altering or extending the terms of a loan agreement linked to a limited recourse borrowing arrangement, while not a direct contravention of the borrowing provisions, does on face value raise non-arm’s length income concerns, an issue mirrored with rent relief.

Audit Commentary

The ATO have issued guidance to SMSF auditors, and the broader SMSF community, to indicate that they will not take compliance action associated with the above issues where a fund has implemented relief on commercial terms.

From an audit perspective, our auditors will not be required to lodge a contravention report for clients who breach these provisions by applying the Government’s commercial leasing principles, and the annual Audit Contravention Report (ACR) will be amended to reflect this. However, where the auditors are not satisfied that relief was provided on commercial terms or was not warranted based on the evidence provided (i.e. the tenants did not suffer from adverse financial conditions as a result of COVID-19) then the auditor can still report and the ATO can review the fund.

As such, the onus will be on the auditors to assess each client’s situation meaning the more supporting evidence trustees can provide the better it will be.

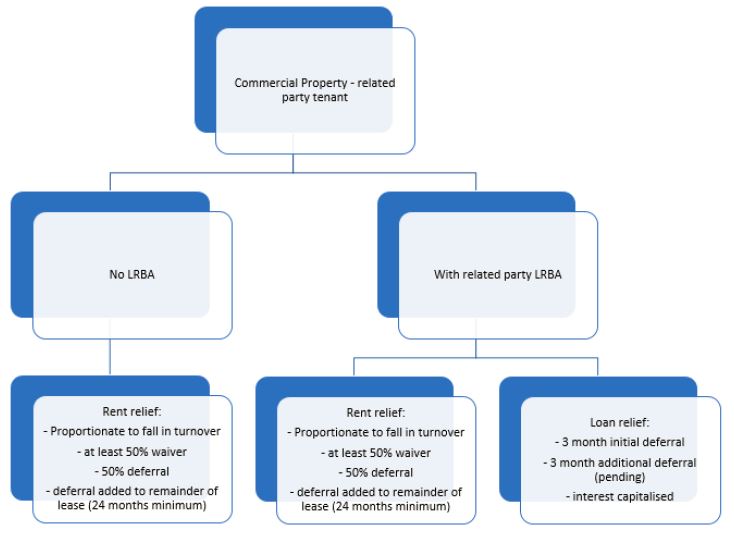

What are the Guidelines?

When a lease exists between an SMSF and a related party of the fund, SuperGuardian would urge all trustees to follow the guidelines provided by the National Cabinet Mandatory Code of Conduct, located here https://www.pm.gov.au/sites/default/files/files/national-cabinet-mandatory-code-ofconduct-sme-commercial-leasing-principles.pdf.

The key term in the title is mandatory. The Code specifically applies to businesses that qualify for JobKeeper i.e. they have experienced a fall in turnover of 30% or more. However, based on the ATOs commentary specific to SMSFs, if a tenant has suffered any adverse financial conditions due to COVID-19, we consider it logical and justifiable for relief to be based on a single set of standards. Should trustees and related party tenants seek to negotiate outside these terms then they will most definitely need to be able to justify that to the fund auditor.

All negotiations must be undertaken in good faith and any relief must be proportionate to the impact.

Step One – Tenant Approach

The tenant needs to request the rental relief and be able to substantiate the fall in turnover. Utilising the JobKeeper basic turnover test, it would be appropriate to compare the period that relief is sought for to the same period last year to determine the turnover decrease. There are alternative tests where circumstances dictate that a tenant can’t make a reasonable assessment against a comparable period. Ultimately, for the purposes of the tenant requesting relief the more supporting evidence that can be provided the better.

Warning: the substantiation requirement for SMSF related party tenants is as much about future compliance as it is the initial negotiation, which presumes all parties will act in good faith. For example, if the tenant indicates their turnover has decreased or is likely to decrease by 80% for the June quarter, the landlord can offer rent relief based on that figure. However, it does not mean that 80% is applicable for all future periods i.e. regular reviews should form part of the negotiations.

Step Two – Applying Relief

If we use the 80% figure as an example, then the appropriate course of action for the SMSF landlord will be to offer an 80% reduction in rent. As per the Code of Conduct at least 50% of this reduction must be in the form of a waiver and the balance, let’s assume the remaining 50%, must be by way of deferral to be amortised over the remaining term of the lease or 24 months, whichever is longer.

Example

Bob and Mary Smith are members and trustees of their SMSF. The SMSF owns the building where Bob and Mary operate a café in the CBD. Their monthly rent is $5,000 and they have seen a reduction in turnover of 80% due to only being able to offer takeaway meals and less people working in the city. As part of their application for relief to the SMSF they would be entitled to rent relief of $4,000 per month (80%).

At least $2,000 of this must be waived and $2,000 deferred over the remaining term (or 24 months). The landlord can waive more than 50% but they cannot seek reimbursement of the amount waived, and there would need to be further justification for the SMSF to offer more than the 50% waiver. Without justification this would raise immediate sole purpose and financial assistance flags.

The Code does provide for the minimum waiver amount to be lower than 50%, but this can only be done in agreement between both parties.

Step Three – Document on Decisions

The following documentation will be required for the SMSF to satisfy compliance obligations and to present to the auditor when the annual return is prepared:

• request from the tenant requesting relief and confirming the reduced turnover

• trustee resolutions acknowledging the request and outlining the agreed terms

• confirmation from the SMSF to the tenant confirming the proposed relief

Warning – we are not in a position to provide advice about the requirements to amend the terms of the lease, but any amendments agreed to above clearly needs to be recognised alongside the existing lease agreement.

Investment via Related Entities

It is not uncommon for an SMSF to invest in a unit trust that holds the property that is leased to a related party, with these investments exempt from the in-house asset rules providing all transactions are maintained on an arm’s length basis. Failure to satisfy these requirements would generally result in the SMSF being forced to dispose of its holding in the unit trust.

As a deferral of rent is akin to a non-arm’s length transaction, taking this action for a property held inside a trust would, under normal circumstances, result in the asset being treated as an in-house asset. However, the ATO have indicated that subject to similar rent relief terms being applied as for directly held properties, they will not treat the asset as an in-house asset in current or future years.

Limited Recourse Borrowing Arrangements

SMSFs with a related party limited recourse borrowing arrangement may be in a position where rent relief has or will be provided to tenants, placing the SMSF under financial pressure to satisfy their loan repayment obligations. The ATO have indicated that repayment relief on the loan will be acceptable providing it is consistent with the terms commercial banks are offering. As a guide, the major lenders are providing a three (3) month payment deferral (not a waiver) with an option to extend for a further 3 months. Interest must be capitalised during this period and added to the remaining term. The ATO have indicated that the terms of the loan must be amended to reflect these changes and evidence is retained that the interest has continued to accrue and has been capitalised. A fund that undertakes this process will not have the non-arm’s length income provisions applied to the property income.

Residential Property

We are currently gathering information available on each state’s position regarding residential tenancy, but at this point in time not all states have legislated their proposed relief measures. Given that ALL SMSF investments in residential property will be tenanted by unrelated parties, the current expectation is that all parties act in good faith and that will reflect an arm’s length dealing. We will provide a summary as part of a more comprehensive “guide to preparing for year ended 30 June 2020”.

Dealing with unrelated parties

The focus of this update has been for those engaged with related parties. The Code of Conduct applies regardless of whether a tenant is related or not. However, as there is a greater compliance and taxation risk associated with related party transactions not being on arm’s length terms it is important that we focused on related parties.

Similarly, the Australian Banking Association have provided guidance on the relief banks are providing for property loans. If an SMSF has a LRBA with a commercial lender then it is appropriate for the SMSF to deal directly with that lender.

To download the PDF version click here.